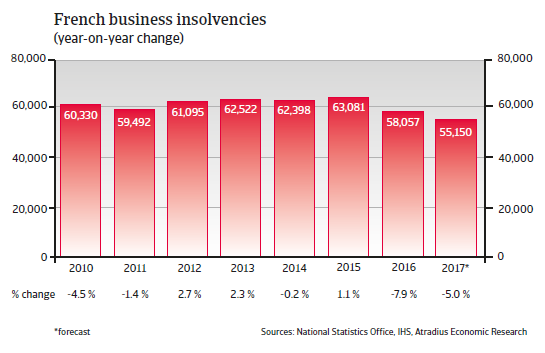

Med mere end 58.000 konkurser i 2016 er konkursraten stadigvæk ca. 5% højere end raten før krisen i 2008.

The insolvency environment

Despite decreases in 2016 and 2017, the insolvency level remains high

French business insolvencies decreased by about 8% in 2016, and in 2017 another 5% decline is expected, in line with the on-going (albeit modest) economic rebound. However, with more than 58,000 cases in 2016 the number of business insolvencies was still about 5% higher than in 2008.

Economic situation

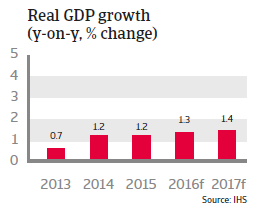

Growth expected to remain below eurozone average

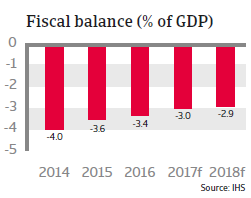

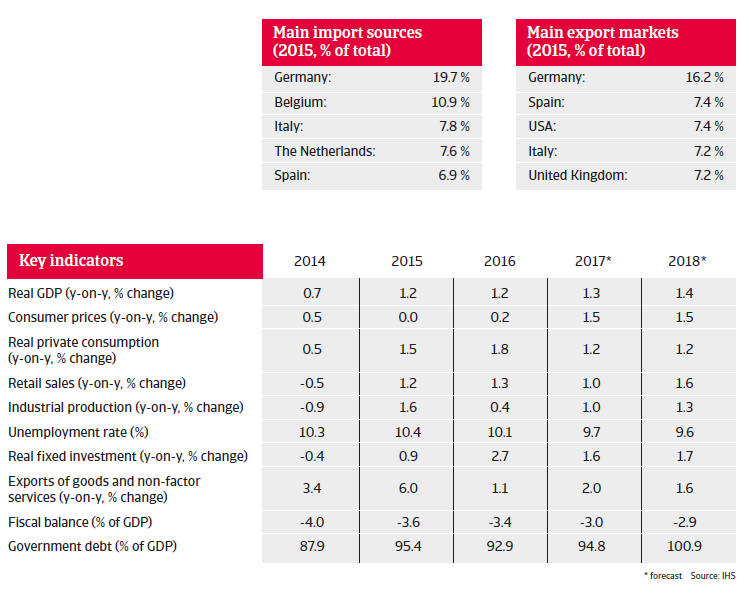

In 2017 and 2018 French economic growth is expected to increase only modestly, by 1.3% and 1.4% respectively; again below the eurozone average. Productivity remains an issue in the French manufacturing sector.

Unemployment, at least, shows a decreasing trend, which should benefit private consumption.