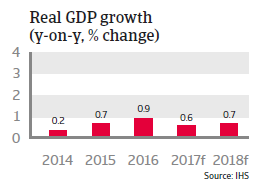

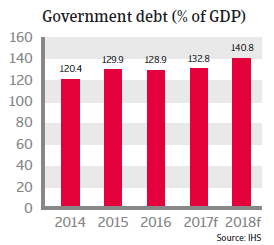

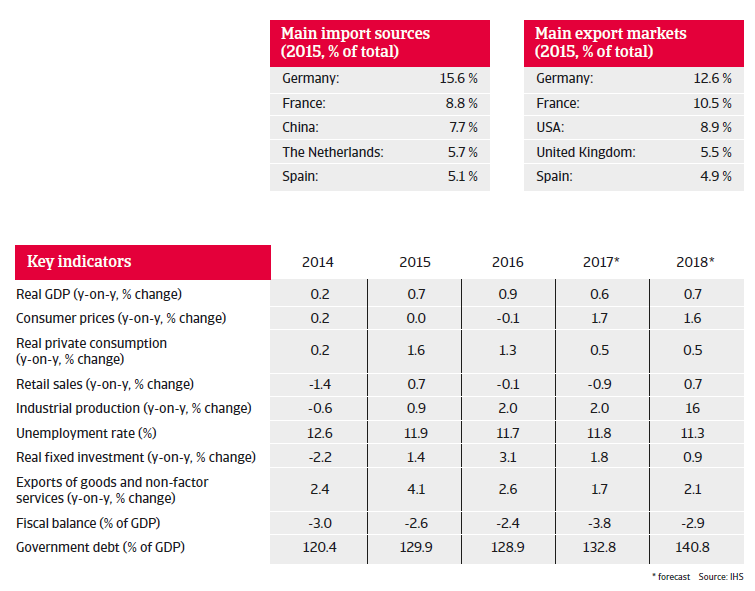

Væksten i Italiens BNP forventes at forblive afdæmpet i 2017, da den internationale konkurrenceevne stadigvæk er et problem og banksektoren stadigvæk er presset.

The insolvency environment

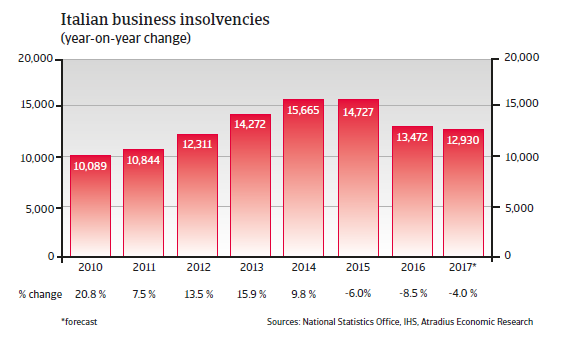

Only a modest decrease in insolvencies in 2017 after years of steady increases

In line with Italy´s weak economic performance over past years, corporate insolvencies registered annual increases between 2008 and 2014, mainly with double-digit growth rates. In 2015 and 2016 insolvencies finally decreased, by 6% and 8.5% respectively. In 2017 a 4% decline is expected, but the forecast number of about 12,900 cases is still more than 100% higher than that in 2008 (6,500 cases).

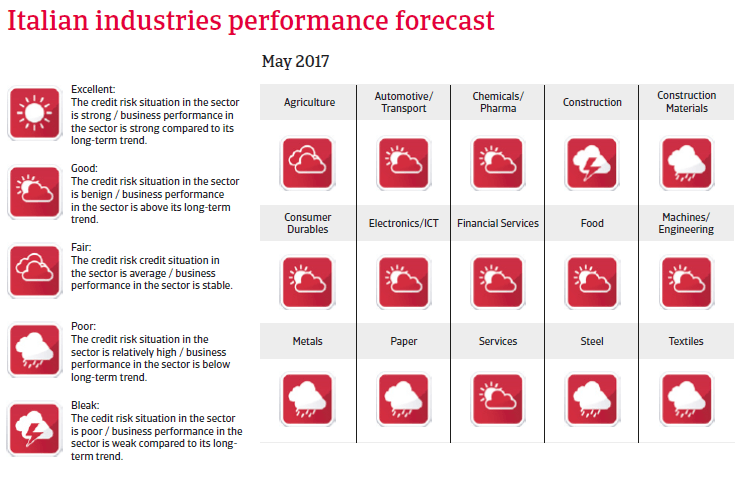

Liquidity problems of Italian businesses are exacerbated by continuing poor payment behaviour, especially by the public sector. Moreover, Italian companies compared to their Western European counterparts, show a higher average gearing – especially short-term gearing.

Economic situation

A feeble rebound with potential downside risks