Stigende konkurrence fra Kina inden for elektronikbranchen kræver produktivitetsstigninger og diversificering af økonomien på langt sigt.

Political situation

Head of state: President Tsai Ing-wen (DPP, since May 2016)

Government type: Multiparty democratic regime headed by popular vote-elected president.

Population: 23.5 million

Relationship with China remains the key issue in Taiwanese politics

Taiwan’s relationship with mainland China will remain the dominant political issue for the island. The political scene is polarised between pro-unification parties (KMT, PFP and New Party) and pro-independence parties, mainly the Democratic Progressive Party (DPP) and the DSU.

The mainland regards Taiwan as a ‘renegade province’ and has repeatedly threatened to invade the island in the event of a formal declaration of independence. After the DPP won the January 2016 presidential and general elections, Beijing has scaled down bilateral relations with the new, more pro-independence minded government.

Economic situation

Economic growth remains subdued due to weak external demand

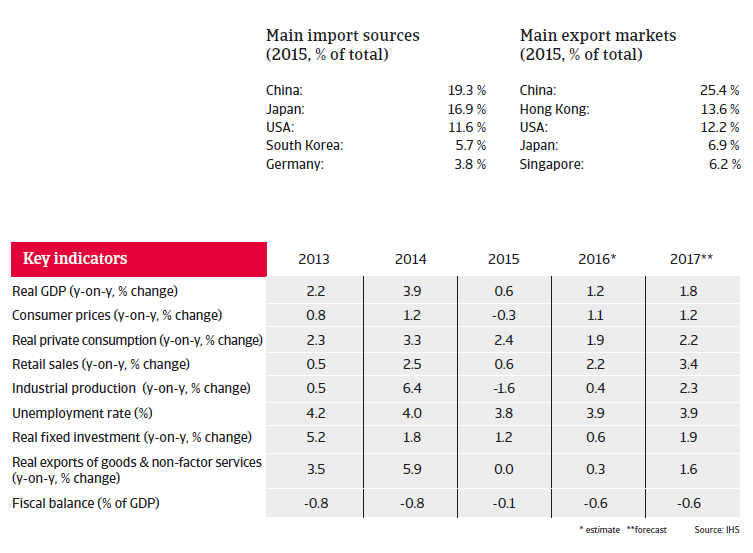

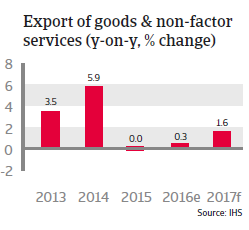

Taiwan´s economy is mainly export-oriented (focusing on electronics and computer equipment, basic metals and plastics), with the export of goods and services accounting for more than 70% of GDP, and with 40% of outbound shipments - mostly electronic devices - destined for China.

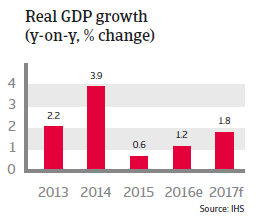

The downside of this dependency has become visible since 2015, as lower demand from China had its impact on Taiwan´s export performance - and consequently on economic growth, which slowed down to 0.6% in 2015 and 1.2% in 2016. Growth will pick up only moderately in 2017, as external and domestic demand are expected to remain rather weak. With inflation remaining below 2%, the central bank will continue to pursue a loose monetary policy in the coming years.

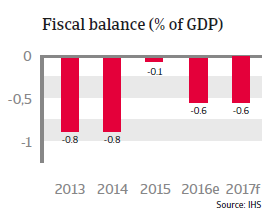

Public finances are very sound, as government debt is low (30% of GDP) and slowly decreasing. The budget deficit will also stay low, at below 1% of GDP in 2017. Taiwan’s external financial situation is very solid, with low external debt. The current account surplus is very large and the country has ample foreign reserves. The large current account surplus makes a strong depreciation of the New Taiwan Dollar (NTD) unlikely, but a gradual lowering is probable if the US Federal Reserve continues monetary tightening.

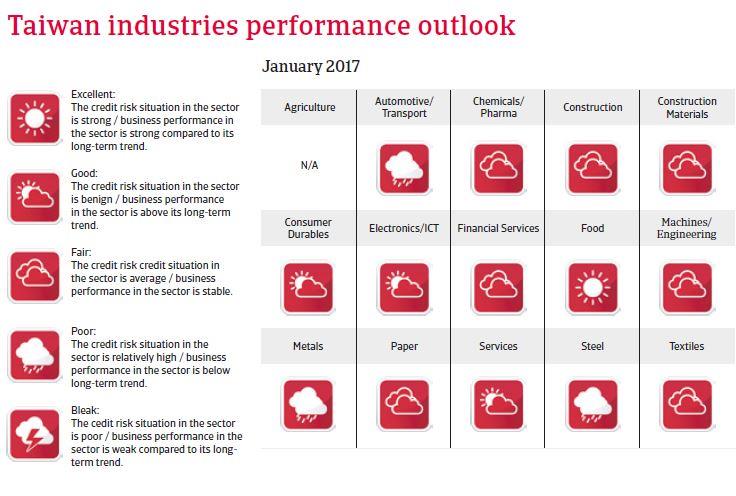

Currently Taiwanese electronics manufacturers still benefit from economies of scale and have managed to lower unit costs to levels often far below those of their competitors, thereby gaining a competitive advantage. Another strength of the industry is its precision and reliability.

Increasing competition from China and other risks

Taiwanese businesses not only suffer from decreased Chinese demand, but also from the fact that China’s industries increasingly climb up the technological value chain. As China competes in key sectors (e.g. semiconductors), Taiwan will have to look for new high value-added alternatives in the mid- and long-term. Therefore, productivity increases and the diversification of the economy are the main long-term challenges. Besides this, the aging of the population is an issue. Taiwan´s working age population has begun to shrink in 2016.

The country also suffers from its political isolation, as other countries are reluctant to engage in free-trade talks with Taiwan. The current administration is reluctant to further deepen the economic integration with mainland China and would like to expand trade with the US and Japan. However, any turn to more protectionist trade policies by the new US administration would have negative effects for the export-dependent Taiwanese economy.